Special December 2023 Market Brief

Sell My Money Market, Are You Crazy?

“I keep on fallin/in and out of love/with you.” – Alicia Keys Fallin’, Songs in A Minor, 2001

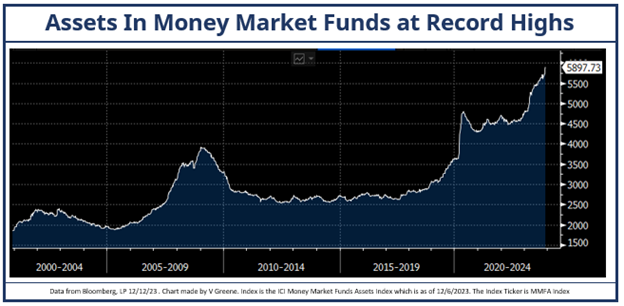

For the first time in 25 years, holding cash has been a benefit and not a drag on your portfolio. Cash and cash equivalents have been an investable asset class since mid-2022 when the hiking cycle started accelerating and investors rapidly fell back in love with money market funds. While your checking account bank deposit rate might still be 0.02%, you can make real money sitting in a money market fund or a high yield savings account. Per www.bankrate.com as of 12/12/23, the top high yield savings rate at an FDIC insured bank is 5.40%, which aligns exactly with the Fed Funds rate of 5.25-5.50%. Money market funds range around 5.25%, a 2-month Treasury Bill is at 5.40%, a 1-year Treasury Bill yields 5.09%, and a 1-year FDIC insured CD at 5.35%. All these are about 200bps+ above CPI and making investors real returns relatively risk free.

Why would we start advocating you consider selling the short-term investments and buying something yielding less? Because of reinvestment risk. The yield curve and bond markets will be dramatically affected as the Fed inevitably moves into rate cuts in 2024. Currently, the Fed has been on pause (no hikes/no cuts) since July 2023 after a torrid pace of 11 hikes in the last 18 months. As the Fed cuts rates, all these nice, juicy short-term yields you are seeing will fade. That 1-year CD right now is fantastic, but the Fed Fund Futures market is pricing in between 100-125bps of cuts in 2024. Meaning, the Fed Fund rate is currently estimated to be around 4.18% by this time in 2024. Bond markets have already started pricing in the rate cuts, and we have seen the intermediate part of the curve rally (bond prices go up and yields fall).

If an investor does not look to lock in some duration and longer maturity fixed income, they face a difficult reinvestment environment and falling yields for the first time in 2 years. It might just be time to start falling out of love with your money market, and back in love with the bond market.