September 2024 Market Brief

USA vs. Everybody Else

“Simple can be harder than complex; you have to work hard to get your thinking clean and make it simple.”- Steve Jobs

Portfolio construction is a delicate balance of diversification vs. conviction. Often the proper allocation is driven by Modern Portfolio Theory (MPT) and an efficient frontier, which was developed in 1952 by Harry Markowitz in his dissertation on Portfolio Selection. MPT theorizes that an investor looks to maximize their return within an acceptable level of risk through a diversified portfolio. This should limit idiosyncratic risks by analyzing investments as they work together, considering correlation, and not as standalone investments. The basic theory is sound, but we feel investors often over diversify and do not correctly understand market risk. Or they are not considering underlying holdings within investment vehicles, minimizing the desired diversification effect. Funds tend to drift, so small-caps often hold mid, and mid-caps hold large and global holds more US than International.

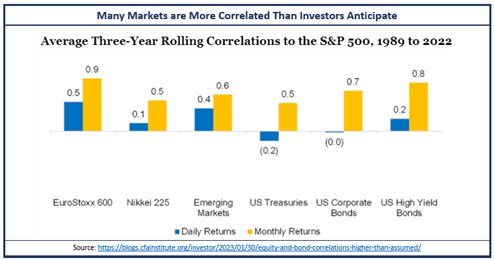

If an investor wants to diversify, they will create a portfolio of stocks, bonds, alternatives, and cash, combined at levels appropriate for their personal risk tolerance to generate a balanced approach. The issue with this approach is that by owning a bunch of different mutual funds or ETFs, you may not be achieving the diversification desired. Also, during times of stress many assets become more correlated and do not allow for the downside protection diversification desires to provide. As you can see from the chart below, high correlation of multiple asset classes with the S&P 500 holds over longer time periods.

So, if assets are more correlated, and correlation increases during times of stress and sell-offs, then construction of an optimal portfolio becomes more about selecting markets with the highest potential return vs. holding for diversification. Which is why G Squared has heavily overweighted US Large Cap Equities for over 5 years, and many of our portfolios hold minimal International and Emerging Markets positions. We feel that the US still has the highest growth potential along with strong fundamentals vs. Europe or China. The argument that significant allocations to underperforming international markets, or any underperforming asset class, is necessary to diversify is simplistic at best. Conviction tends to drive returns; not over diversification and the need to hold a little bit of every asset class. We want to own the asset classes we feel perform best, whether it’s in achieving upside in the market, higher income, or downside bear market protection, own what works and skip out on the buffet style portfolio. Yes, one needs enough diversification to minimize risk, but that does not mean owning absolutely everything. #TeamUSA!