April 2025 Market Brief

Anatomy of a Bear

“Be fearful when others are greedy and be greedy when others are fearful.” – Warren Buffett

The tariff shock continues to reverberate throughout the market with the Trump administration continuing to defend its actions, focusing on, “sometimes you have to take medicine” as they seek to rebalance trade deficits and re-shore manufacturing and production back to the USA. This is a rapidly developing situation that is likely to see further downside until we get some negotiations. Tariffs are likely here to stay, even if they are rolled back less onerous.

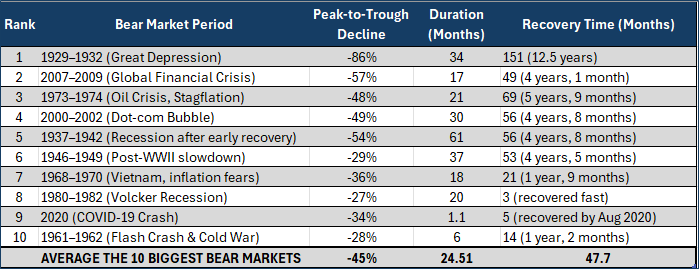

The effect of the large tariffs has caused one of the sharpest and rapid drops in recent history. Beyond COVID, 1987 (Black Monday), and the Great Depression (1929), this was one of the most rapid declines in modern markets. Also, due to the growth in markets, the $6.6 Trillion in market value lost was record breaking. We are now faced with, “How bad could it get?” And while we hate to play the worst-case scenario game, we think context is always crucial. Below is a table of the 10 worst bear markets in modern history, their duration, and how long it took to recover. As you can see, the average worst-case bear is -45% drawdown lasting about 2 years and taking almost 4 years to recover. Ugly, but often short and swiftly recovered.

Every bear market is different, but they all feel terrible and it feels like we may be facing the end of the world. And while we believe this market could get worse and drag us into a recession, we are also not panicking. Let’s say we go down to the average bear; we would be almost halfway there and it’s happening at warp speed, which often sees a rapid snapback – think COVID. We caution against trying to time it and as it gets worse, we see investors throw in the towel often near the bottom. It is going to continue to feel horrible. All the data likely gets sharply revised down, earnings slashed, price targets cut, and pundits likely howling that this one is different, and the end of modern society is coming. All this likely signals a bottom is coming sooner rather than later.

Panic is infectious. Watching your portfolio lose large sums daily is torture. But bear markets tend to be the best time to be opportunistic and deploy capital at cheap valuations. Does anyone think META or CAT are not going to survive this? No. Did they need a re-rating on price to reflect possibly lower earnings? Yes, which has happened rapidly. Buy low. Sell high. Don’t be **that** investor who falls victim to emotional investing and sells in the midst of a bear market. It may protect in the short term, but when the market turns, you are often left on the outside looking in and miss the recovery. Keep calm and carry on.