October Market Brief

Stagflation

“Find out the cause of this effect/or rather say, the cause of this defect/ for this effect defective comes by cause.” -Shakespeare, Hamlet, 2.2 101-103

As October begins to wane, we saw the market rebound sharply from September lulls and 3rd Quarter earnings come in strong across the board. Investors are watching this market climb up a wall of worry and shrug off all the macro events that seemed poised to derail it. The latest worry of the day is the US Economy entering a period of Stagflation. Stagflation (or recession-inflation) is a period of rising inflation coupled with slow economic growth and rising unemployment. Inflation tends to go hand and hand with a hot and growing economy, not a slowing one.

What causes Stagflation? Often it is driven by a supply shock and/or poor government policy growing monetary supply too quickly. The 1970’s, first in the UK and then in the US, are a good example of Stagflation; both countries were hit hard by the Oil Embargo of 1973. Supply shocks can be difficult to fix depending on the root of the cause and the fungibility and storability of the product. Oil & Gas shortage is a lot harder to fix and more consequential than the great Tickle Me Elmo Doll shortage of Dec. 1996. Our supply shocks (semiconductor chips & commodities) may be more quickly resolved in 6-12 months than those of the past.

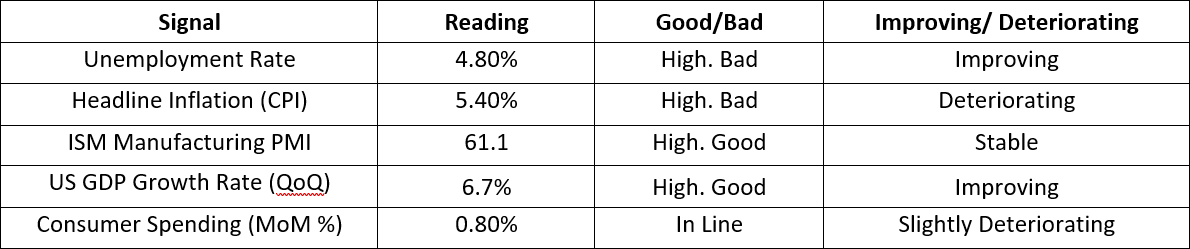

Let’s review the checklist of indicators and where we are now on Economic Data (as of September 2021):

Employment Data Quoted from Bureau of Labor Statistics https://www.bls.gov/bls/newsrels.htm#OEUS

The labor market is currently one of the great economic quandaries; it’s a tight labor market with millions of open employment positions, yet still stubbornly high unemployment numbers. As of August 2021, there were 8.384mm Americans unemployed, for comparison February 2020, pre-pandemic that rate was 5.8mm. While at the same time, there are a historically high 10.4mm job openings currently available. The reasons behind the obstinately high unemployment rate vs. the historically high job vacancies have confounded economists but most likely come down to lingering pandemic fears, availability of childcare, enhanced government monetary support, and the feeling that the workers have swung to “power” thus may be able to negotiate a better job down the road as employers get more desperate to fill vacant positions. But as you hear about Stagflation, which I will wager will the word of the 4th Quarter and mentioned quite frequently, understand that while some of the signals are beginning to turn difficult, it is not a certainty we are going to tumble into the 1970’s all over again. More frequently than not, by keeping your allocation, and not positioning your portfolio for the worst-case scenario, you will generate more consistent returns. Or as Robert Arnott opined, “in investing, what is comfortable is rarely profitable.”