February Market Brief

Markets on a Warpath

“The first casualty when war comes is truth.” Senator Hiram Warren Johnson, 1918, Speech, U.S. Senate.

Russia is once again looking to reclaim old Soviet Union territory and influence, this time with its sights set on Ukraine. Currently, as of writing this on Tuesday 2/22/22, Putin is following his gameplan of targeting Rebel held separatist territory in Eastern Ukraine as they did in 2008 with Georgia as well as 2014 in Crimea. Russia is, of course, claiming their troops are there for “peacekeeping.” The 2008 Georgian invasion lasted only 12 days and the 2014 Crimea annexation lasted 34 days; during these phases markets were very calm and actually posted slightly positive returns on the S&P 500.

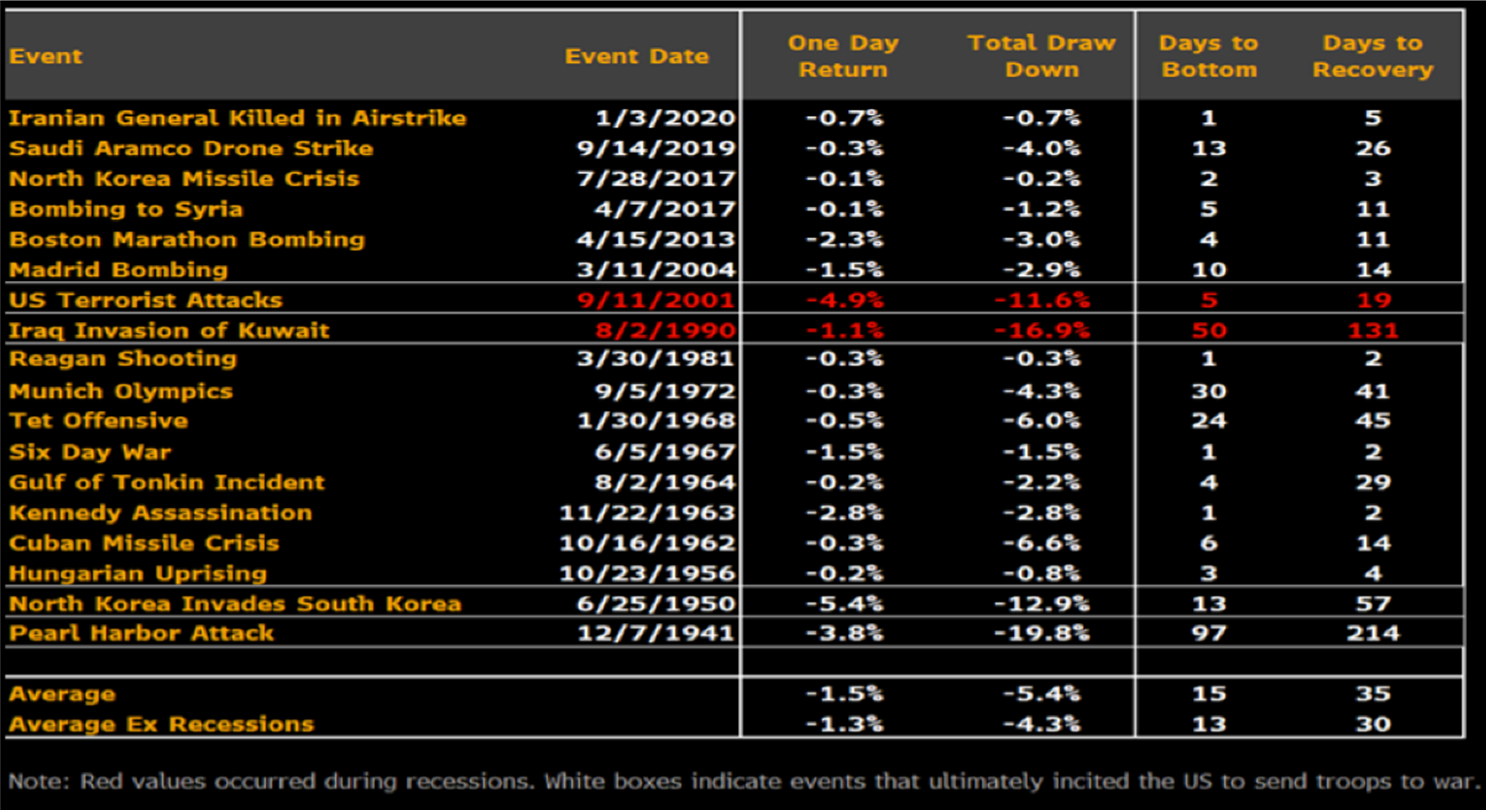

The history of markets and conflicts is complex. One would think a large geopolitical event, such as war or invasions of other sovereign territories, would be a dependable drag on markets. However, when you look at conflict in context to market returns, the correlations to bear markets are just not there. Below is a concise table compiled by Bloomberg reviewing a few of the major terrorist, war, and conflict events since WWII and their effects on the markets. You can see on average, the markets pulled back 15 days and lost -5.4%. History doesn’t always repeat itself, but it does often rhyme. I always caution investors against the most dangerous thought process in investing: this time it’s different. It is often difficult to separate your feelings and emotions from investing. Turbulent times in the market can test the mettle of even the most seasoned investor.

So, what happens next? Our base case scenario is Putin follows his Georgia & Crimea playbook and only targets Rebel held territories. We caution against market timing this crisis as selling now may only save some short-term pain. Knowing when to get back into the markets is the more difficult decision and may leave you sitting on the sidelines. I know it’s not fun losing money. Sometimes it’s best not to look at your portfolio during times of market stress. It can be like Chinese water torture, and you can talk yourself into bad choices because of fear and visible, quantifiable loss that just eats away at your ability to think rationally. Never forget, buy low, sell high remains a good adage.

1 Data gathered by Bloomberg Terminal