April 2024 Market Brief – War and Markets

“In the midst of chaos, there is also opportunity.” Sun Tzu, The Art of War

The Middle East recently went from simmering to a full-on boil with the Iranian missile and drone attack on Israel. This attack (in retaliation for a suspected Israeli strike on the Iranian Embassy in Syria) raised the stakes that Israel could retaliate with a direct attack on Iran, and from there, all bets are off on controlling the situation and how it might escalate. War is a terrible thing, and the human cost and suffering goes beyond the economic consequences discussed here. However, our job is to advise on a potential market reaction and not to weigh in on politics.

War and conflict often have less direct impact on the stock market than investors perceive. There have been multiple major conflicts, terrorist events, and wars in the last 30 years, and the stock market has each time been able to recover quickly and continue its trend. The historical pattern for an outbreak of war, or major terrorist event, is a knee jerk sell off of around 3-5%, followed by a swift recovery. Outside the equities markets, with this conflict we would anticipate Gold prices to rise and Treasury bonds to rally in a flight to safety and quality. We could also see extreme volatility in oil prices and energy stocks, and likely upward pressure on oil with multiple major shipping lanes potentially interrupted or halted depending on the severity of the conflict. There may be some sectors and stocks that suffer more than others. For instance, it is likely prolonged conflict in the Middle East continues to boost US Defense Contractors. On the other hand, travel stocks would likely fall especially those that have direct exposure and routes in the Middle East. Inflation is another area that could be adversely affected as rising commodity costs and disrupted shipping could keep upward pressure on US Inflation and imports.

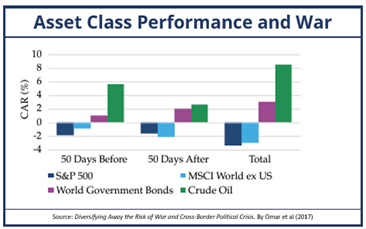

Markets don’t always react the way we do emotionally as humans. After Russia invaded Ukraine on 2/24/2022, the S&P 500 actually rose on 2/24 and 2/25. However, 2022 was a bear market so we did see markets fall, but that was driven more by the Fed and a rapidly raising interest rate policy rather than Geopolitical risk. The chart below shows a 2017 study of asset classes measured over 50-days before and 50-days after the outbreak of war. The research by Omar, Wisniewski and Nolte found Oil did the best, followed by World Government Bonds over the short time period immediately before and immediately following the start of a war. War is hell, with a high cost to participants and locals, but do not let fears over Geopolitical conflict drive your investment policy. History shows, staying the course has proven profitable.