August 2024 Market Brief – What the hell just happened

“Chaos was the law of nature; Order was the dream of man.”- Henry Adams

Late August brings inklings of fall; days start to get shorter, the brutal heat turns more tolerable, kids return to school, and the mosquitos (hopefully) die away. It’s not just the season looking to turn the page, but markets often turn the page in August from summer rally into fall volatility and drawdowns. September is, by far, the weakest month of the year, as well as an election year tends to bring some sort of “October surprise.” August has brought plenty of surprises so far, including a historic intra-day VIX spike to 65.73 on 8/5 as the world panicked about everything from Warren Buffett selling AAPL to an ugly unwind of the Yen carry trade. The VIX has not been above 65 since 2020 and 2008, showing just how hard and fast the market was ready to panic. This fear has subsided and the VIX is back below 15. If you had been on a desert island for all of August so far, you would have never known that the financial world was preparing for impending doom for a week or 2 as indexes are now mostly flat or positive on the month.

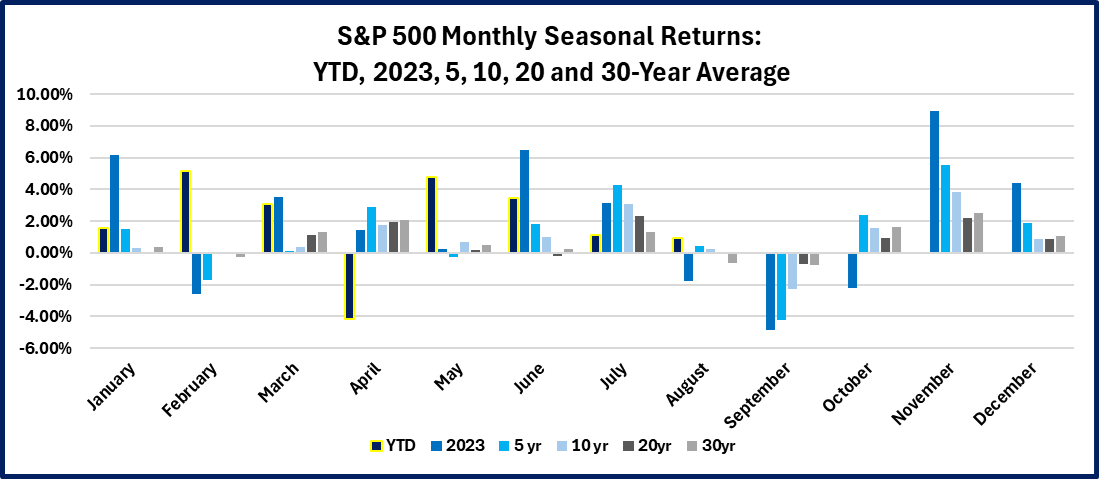

Volatility tends to pick up during the fall as traders return to their posts and election years tend to make markets even more skittish. Even though 2023 was a strong year (up 24.23%), during the fall period of Aug-Oct markets fell -8.01% and logged 3 straight negative months before a strong year-end rally. Q3 is the weakest quarter of the year even during a bull market and Q3 can see a solid 7-10% pullback. September is the killer month, with the S&P 500 logging negative returns over a 5-year, 10-year, 20-year and 30-year period. The last time the S&P 500 was up in September was 5 years ago in 2019.

As markets turn over a new leaf to weaker seasonality, beware of fall follies and be prepared for higher volatility and the potential for bigger drawdowns in the market. But a few bad months does not mean the end of a bull market. It’s often best to bear the short-term loss and hang in there for the high probability of long-term gains and a year-end rally.