February 2025 Market Brief

The Uncertainty Premium

“There are decades where nothing happens; and there are weeks where decades happen.”- Vladimir Lenin

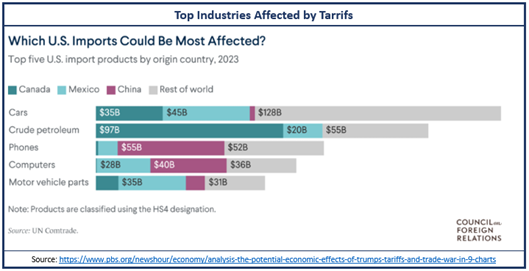

As we kick off February, markets are weathering multiple assaults on their bull run. We should be rejoicing a pickup in profit growth across multiple sectors with the S&P 500 on pace for a 10% growth in profits vs. 7% anticipated. But earnings are taking a backseat to politics as the Tariff War 2.0 began in full 2/1/25. The opening salvos of Tariff War 2.0 began against Canada and Mexico with a 25% tariff on all imports from Mexico and Canada, exempting energy resources from Canada at 10%. China will also see a 10% tariff on all imports. Importantly, the US government is also suspending the “de-minimis” exemption for packages and shipments under $800 addressed to individuals. The de-minimis exemption has been a huge driver of global e-commerce – think Temu, Shein, or baubles from Esty international sellers. The point of the de-minimis exemption was to allow insignificant and small items to be disregarded for regulations, duties, or taxes in the context of international trade. Suspending this exemption makes international e-commerce exponentially more difficult and expensive.

Tariffs typically come in waves and involve initial tariffs, retaliatory tariffs, and some sort of agreement for smoother trade going forward. If there is not a reduction or more carve outs, these would be the most substantial tariffs since the 1930’s and the Smoot-Hawley Tariff Act, which increased tariffs on over 20,000 imported goods in response to the Great Depression. The rationale of the tariffs is to put pressure on our trading partners to stop illegal immigration as well as fentanyl production and support. Secondary is to reduce our trade deficit and continue to pressure companies to onshore, which most companies already were in process of post-COVID. As robotics and automation have gotten better, the higher US labor cost is less of a barrier and there have been multiple large factory projects in the US in the last 5 years including from INTL, TSM, and multiple automakers. The re-shoring of manufacturing was a trend in process, but suddenly the nearshoring (building in Mexico or Canada) looks riskier. Building new supply chains also takes time to shift and adjust.

Mexico exports about 80% of its good to the US, and Canada exports 78%. This makes both countries extremely reliant on the US and are some of our largest trading partners. But the US only imports 14% and 15% from Canada and Mexico respectively, and 71% of the estimated $3.17 Trillion in imports comes from the rest of the world. China exports about 15% of its goods to the US and the US imports about 14% from China, making both countries less reliant on unilateral trade. Both Canada and Mexico are much more reliant on exports to the US, and the more recently negotiated trade agreement (USMCA) saw US companies continue to expand supply chains into both countries. This is an evolving situation, with potential for rapid adjustments and sharp market and currency moves. Don’t panic (or pre-panic) trying to game what may occur, as this will be fluid and effects on GDP and earnings are still unknown.