January 2024 Market Brief

Running of the Bulls

“In bullfighting they speak of the terrain of the bull and the terrain of the bullfighter.” Earnest Hemingway, the Sun Also Rises

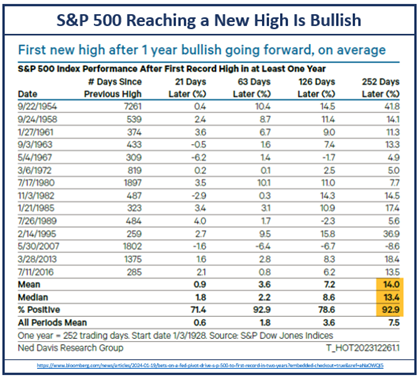

The S&P 500 recently (finally!) hit a new all-time high, after 512 consecutive trading sessions without a closing record. This marked the official end of the bear market that started in 2021 and tends to signal the bulls are in control and markets may potentially push higher. After hitting a low of 3,577.03 on October 12th, 2022, the S&P 500 rallied over 35% and finally surpassed the 4,796 prior high notched in early January 2022 before the bear market selloff. History favors the bulls when it takes over 500 days to hit a new high coming off a bear market. Per Ned Davis Research, the S&P 500 has risen 13 out of the 14 possible times it has taken longer than 500 days to hit a new high, with a median return of 13%.

Further research shows that since 1957, there have been 16 major advances of greater than 20% without a -20% pullback in the S&P 500. These large upswings depend on whether it was associated with recovering from a recession or just a strong bull run. But on average, per the Leuthold Group1, even if there are no recessions preceding it, the bull market lasted 35.2 months and moved up 74.9%. We are currently up 35% in a little over 14 months, so may still have room to run. The question on everyone’s mind is whether we will eventually run into a recession. History says “yes,” but it may be a year or 2 down the road. So, for now, the bulls have a lot of historical and technical supports; even if the macro and fundamentals feel weak and stretched. Until markets start trading off fundamentals, or the gloomy macro starts to matter, the technical signs point higher in the near term. Each investor must choose their terrain (allocation) for this bull market!