July 2024 Market Brief – Through the Looking Glass

“Nothing would be what it is because everything would be what it isn’t. And contrariwise, what it is, it wouldn’t be, and what it wouldn’t be, it would. You see?” Alice’s Adventures in Wonderland, Lewis Carroll

It’s a full-time job staying sane in this world gone mad. Politics are polarized and evolving rapidly, the economy keeps giving mixed signals vacillating between growth and being on life support, and the markets just violently rotated out of the popular mega-cap tech trade and into the unloved small and value sectors. Whenever we see stress ratchet up, investors tend to want to panic. Is this the end of the bull market? Is the AI bubble popping? No, and no. But no market is immune from gravity, no sector can go up in a straight line, and no stock can avoid inevitable pullbacks and selling pressure. The Friday Crowdstrike Global IT outage was just extra fuel on the fire of an already spooked market as the world locked up in the blue screen of death.

It was always likely that at some point the Magnificent 7 (AAPL, AMZN, GOOGL, NVDA, MSFT, META, TSLA) took a breather and consolidated. It’s a bit unrealistic to not experience some drawdowns, even in a strong bull market. It is a very normal pattern in an upwardly rising bull market to see a pullback of 7-10%, a consolidation and pause, and then a push up to higher highs. Not every day can set a new record close! The S&P 500 averages a -10% correction about once every 10.5 months, according to Wren, and has not come down -10% since October 2022. We believe the tech trade is bending, will face some pressure, but not broken and the bubble has not popped yet. For now, the Magnificent 7 are still expected to show significant earnings growth over the market.

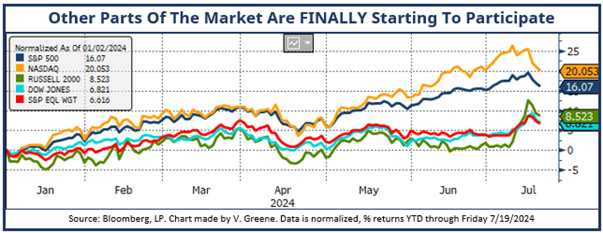

The recent market action is not all doom and gloom as we had new leadership emerge in small caps along with value sectors. This is not a bad thing, it’s a sign of a healthier market that we are getting the breadth we so badly wanted. One of the major knocks on the bull market run is how narrow the leadership had become. In mid-July small cap stocks proved their death had been highly exaggerated. Value, the Dow and the S&P 500 Equal Weight all languished in Q2, beaten badly by the large tech and communications stocks. But for the period from 7/10-7/19 Financials and Utilities were the strongest sectors while the Magnificent 7 stumbled. While it’s never fun to lose money in the market, we hesitate to call the end of the tech trade unless earnings season invalidates it. For now, we believe technology is bending, but not broken, and will likely prove it has the earnings to support further upside. We also anticipate investors that had FOMO over the AI trade, and the record amount of money parked in money market, will step in and provide support.