June 2024 Market Brief – Death and Taxes

“Cause from those total wages earned/Down to that net amount that’s due/ I feel the painful sense of loss between the two.” Johnny Cash, After Taxes

All that is certain in life are death and taxes, but taxes are about to get a whole lot less certain. We are potentially exiting a period of decades of more tax friendly policies and may see the pendulum shift towards higher tax rates for individuals and corporations.

The top marginal tax rate has been falling steadily since the 1960’s when it peaked at 91% (Post WWII), coming down to 35% in the mid 2000’s, then rising to 39.6% before the Tax Cuts and Jobs Act (TCJA) brought it to where it sits today at 37%. Taxation has always been a touchy subject in the USA (some gentleman in Boston had some critical feedback regarding taxation on tea in 1773 and it’s been a conflicted history ever since). From Excise Tax to the 16th Amendment, and finally the Revenue Act of 1913 codifying income tax as legal, it’s been a constant kerfuffle to set taxes at appropriate levels.

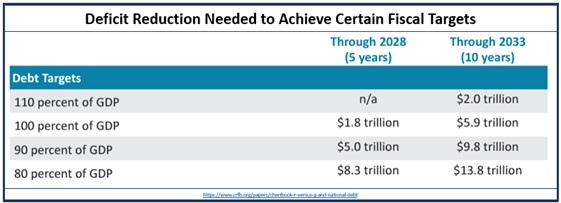

Why am I fairly certain taxes will be going up? Our rapidly rising deficit and interest payments demand new revenue sources. Per the CRFB.org1 (The Committee for a Responsible Federal Budget), interest costs are likely to surpass Defense and Medicare in 2024 with spending on interest currently projected at $870B vs. National Defense at $822B. In 2025, interest expense on debt is also projected to rise to 3.1% of GDP (up from 1.6% in 2020), which may come close to exceeding the record 3.2% set in 1991.

The 2017 TCJA will need Congressional action in 2025 to be extended, which in this current environment, expecting a functional and rational government may be a stretch. Major sections of TCJA that are set to change include: the top marginal tax rate, AMT, expansions of the standard deduction, limits to SALT, and exemption limits to the estate tax. We strongly advise that you review your estate plan in 2024-2025 as we deem it highly likely that the current estate tax exemptions will be reduced. Continuing the child tax credit is a much easier sell than raising or keeping estate tax limits. The current exemption is $13.61mm per individual and will likely revert to $7mm/individual (pre-TJCA levels), or potentially lower. There have been estate taxes since the 1800’s (called the Death Tax) but in recent years, the exemption levels have grown dramatically. Back in 2001, the exemption amount was only $675,000/individual, before slowly ratcheting up to the $2mm level in 2008. 2025 may be the first time since 1935 that the exemption levels are reduced. No reason to panic, and with it being an election year, you should expect a lot of crazy tax policy to be discussed and mostly not implemented by whichever party gains power. But plan accordingly for your estate and start reviewing with your advisor and CPA about potentially appropriate planning strategies to maximize the higher current exemption levels.

1 https://www.crfb.org/blogs/do-we-spend-more-interest-defense