December 2022 Market Brief

New Year’s Resolutions

“It’s New Year’s Day here on the border, and it’s always been this way.” Charlie Robinson, Good Times, 2004

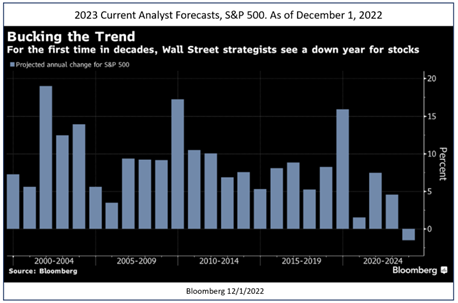

The average projection for the S&P 500 as of December 1st is 4,009. Depending on where we close 2022 this could be a flat, or down year looming for 2023. For the first time in over 2 decades Wall Street strategists are calling for a down year in the stock market in 2023. The last time strategists forecasted a negative market was 1999. The dispersion between analyst views is also the highest in over 15 years. With the spread between the highest and lowest price target for 2023 on the S&P 500 being 32%, Binky Chadha at Deutsche Bank AG has the highest target of 4,500 and Mike Wilson of Morgan Stanley one of the lowest at 3,900.

It is also a rare phenomenon for the stock market to be down 2 years in a row. The last time this happened was 2000-2002, and before that not until 1973-1974. While there are many headwinds with a Hawkish and tightening Fed as well as potential for unemployment to rise in 2023, we are also not facing the same bubble that the tech crisis of early 2000 was. Each market cycle is defined by different drivers. While we have seen a crypto winter and Thematic meltdown (think Coinbase or Peloton), there are pockets of opportunity. We do think Q1 could be ugly, as well as December looks to be facing a lot of downward pressure and bearish looking charts. So, hang on to your hats next few months as we believe the markets could retest and push lower before finally turning bullish. But we continue to focus on quality and cash flows, overweight value vs. growth and nothing wrong with earning some money sitting in T-Bills while we wait! Maybe we will all have a happy new year and see 2023 turn this bear around for good.