July Market Brief

Life, Liberty, and Pursuit of Rate Hikes

“No one really knows how the parties get to “yes”/ The pieces that are sacrificed in every game of chess/ We just assume that it happens/ But no one else is in the room where it happens.” Lin-Manuel Miranda, Hamilton: An American Musical, The Room Where It Happens, 2016

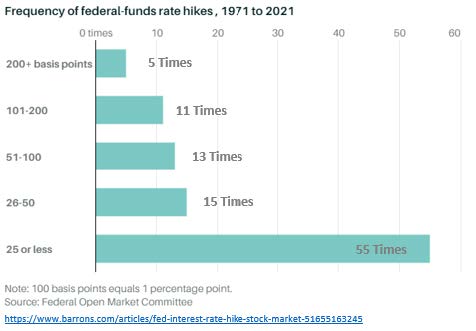

Markets have struggled to find direction the last 30 days. After the dramatic sell-off in the first half of the year, since June 15th the market is moving mostly sideways ranging +/- 2%, looking for a direction to go. We are between major technical indicators, and charting data is mixed without a solid signal if we found bottom or if another sell-off is coming. All eyes are on quarterly earnings releases over the next few weeks as well as the Fed meeting July 26th-27th. We wait with bated breath to see if they will increase rates 0.75% or a full 1.00% to fight against the persistent, stubbornly high inflation. The meeting notes will be deconstructed with a fine-tooth comb, looking for signals about economic health and the speed and magnitude the Fed plans on moving. Our opinion is they should go the full 1.00% as the labor market is strong and they need to be more aggressive about taming inflation. They are late to the inflation party, and they know it. 1.00%+ has been done 16 times in the last 40 years, they should not fear it!

The history of the Federal Reserve mirrors the founding of our nation. The first central bank action was by the Continental Congress in 1775 issuing continental money notes to finance the American Revolution. The First Bank of the United States was formally founded in 1791 by Treasury Secretary Alexander Hamilton. The Fed went through some fits and starts, and a few different iterations before becoming the modern Fed we know now in 1913 when President Woodrow Wilson signed the Federal Reserve Act. Every Fed action is meant to be helpful; to solve some problem, finance a war, or support economic expansion. However, every action has an equal opposite reaction and, in the 200+ years of operation, the Fed often is unprepared for the reaction to their well-meaning actions.

The forces currently acting upon our economy are numerous and fierce. Our current thesis remains a recession, a falling stock market, and companies having too many headwinds to grow profitability and earnings in this environment. We remain cautious and playing defense. The historically strong US Dollar, highest inflation in 40 years, a Hawkish Fed, a dislocated labor market with low unemployment, and lingering supply chain stresses will all drag on profit growth. And that pesky COVID issue continues to linger and refuses to go away. So, for now it’s the Charge of the Hike Brigade and a tightening market.