May Market Brief

Should I Stay or Should I Go?

“I am to wait, though waiting so be hell.” William Shakespeare, Shakespeare’s Sonnets, Sonnet 58.13

2022 has been a volatile and difficult year for both equities and fixed income. After six straight weeks of losses in the equity markets, investor sentiment has soured, and experts are pontificating on where the market bottom will be found. During these challenging down markets there is an overwhelming desire to sell out to protect yourself from further losses. Seems a straightforward strategy to stop the bleeding; sell out, sit in cash, and buy back when markets have gone lower. Investors using this strategy typically violate the prime directive of investing: buy low, sell high. The future is going to surprise us somehow, be cautious on “knowing” exactly what will happen and the markets future trajectory. 2020’s remarkable rebound from the pandemic is a recent example of markets surprising investors.

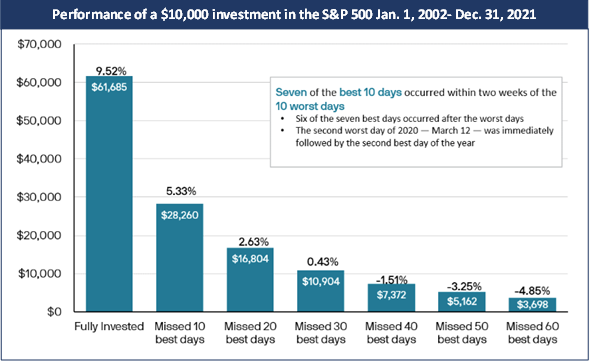

Market timing is historically difficult as the bottom is often an enigma. For every investor who gets it right, there will be thousands that get it wrong and end up losing money instead of protecting their portfolio. Typically, selling out to protect does work short term as you can avoid some of the persistent downside pressure. However, when the market finds a bottom and rebounds it often happens extremely rapidly and without a flashing buy signal. Miss those first few rebound days, and you miss the best gains. Below is a helpful chart from J.P. Morgan on the risks of market timing vs. staying invested. The chart also highlights an important fact: six of the seven best days occurred after the worst days. Did we find a bottom on Friday May 13th? Unlikely, but possible. And if we didn’t, best to hang in there and stay the course. Dark, difficult days in the markets tend to also be good buying opportunities for long term investors, as many companies are trading at more attractive valuations. At the end of the day, this too will pass.