“The road goes on forever, and the party never ends” –Robert Earl Keen, West Textures, Sugar Hill Records, 1989.

How does a bull market die? Conventional wisdom says that it is not by old age, its policy error. Killing off a bull market is harder than one may think. Market history says an average bull market lasts anywhere from four to eleven years, and those with strong first year gains have been longer bull market eras. We believe we are in a normal bull market coming off a recession. Yes, it was the fastest recession in history- blink and you missed it- only 33 days from peak to trough according to CFRA, but it was still a classic bear market drop. We still feel bullish on the year, and believe this market has legs to rally further. Per CFRA again, only 4 of the past 12 bull markets did not make it to 1,000 days. The recent bear market bottomed on March 23rd, 2020 so as of April 23rd we are on day 396.

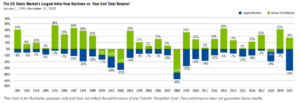

Remember, markets are volatile and can correct 10-15% intra-year. It is a normal and healthy response to consolidate before pushing higher. Already we have seen rolling corrections in 2021- just certain sectors of the markets corrected at different times muting the effects. In February and March tech and growth pulled back almost 15%. Then, energy experienced a recent March/April 12-14% decline from its highs along with Small Caps. The chart below from Franklin Templeton illustrates intra-year declines on the S&P 500 vs. annual total return over 30 years. It is very common to have volatility and 10% drawdowns, but in 25 of the last 30 years, the market ended the year with positive total returns.

The wall of worry is being climbed. Threats seem to be amassing all around us, however you always want to keep your base case assumption in mind; that the world is not about to becoming a flaming dumpster fire of chaos and our economies will continue to recover and grow from COVID recessions. Growing economies should power higher earnings, which help to support stock market growth. We are keeping a watchful eye on the bond market, the Fed, and interest rates as all of those could tip the scale against us at some point, but for now we remain committed. As David Farragut famously said, “Damn the torpedoes, full speed ahead!”