May 2024 Market Brief – Keep Calm and Rally On

“Spring is the time of plans and projects.” Leo Tolstoy, Anna Karenina

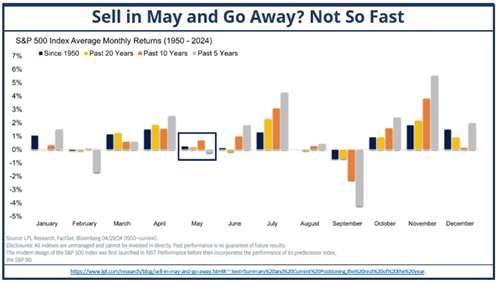

May gets a bad rap about being a capitulation month in the markets. Sell in May and go away, the adage goes. But it’s not May that is the problem, it’s fall. Typically, when looking at 6-month seasonal patterns, the May-October 6-month period is one of the weakest, but if you look at it on a month-by-month basis, May, June, and July are not horrible months. The problem comes in September. September is by far the weakest seasonal month of the year, followed by February, but that is not May’s fault.

We are currently in a strong bull market and feel it’s better to hang on to your equities during the summer than dump them due to an old wives’ tale. If you review the recent history of June and July, both are strong positive months and investors would be remiss in trying to time the market based on a myth. According to Manulife,1 over the last 10 years May to October were positive 80% of the time with an average return of nearly 5%. Additionally, ‘buy and hold’ beat ‘sell’ in May over 10 years with a 10.4% return vs. 5.5%. July has been one of the stronger months over the last 20-years averaging 2.29% in the S&P 500 according to Bloomberg’s seasonality analysis. In our opinion, the risk comes in August-October with September being the seasonally weakest year of the year. Over the last 5 years, the S&P’s returns in September were: 1.72%, -3.92%, -4.76%, -9.34% and -4.87% with an average return of -4.23%.

So, where did this adage come from? It may date back to old English traditions when stockbrokers would go on summer vacation and not return until the fall. So, it’s less based on fact, and more based on the assumption nothing will happen over the summer since all the traders are on vacation. With technology, you can bet hedge funds are working from the beach and that the summer lulls are no longer to be avoided. We see the rally continuing through the summer, although as we approach August and the fall, prudence may be needed even in a strong Bull rally. For now, it continues to be keep calm and rally on with more and more support for the bull market appearing.