“Skepticism is as much the result of knowledge, as knowledge is of skepticism.” –Homer, The Odyssey

As markets continue to rise there is still a sense of foreboding that we are just waiting for the bottom to drop out. Sell and May and go away? Or keep calm and carry on? Some believe this market is like the story of Icarus who flew too high, and consequently crashed and drowns. His father Daedalus warns him of complacency, and then of hubris, but Icarus does not listen, and his pride causes him a tragic ending. One can find economic naysayers and warnings that, like Icarus, the markets are running too hot and flying too high.

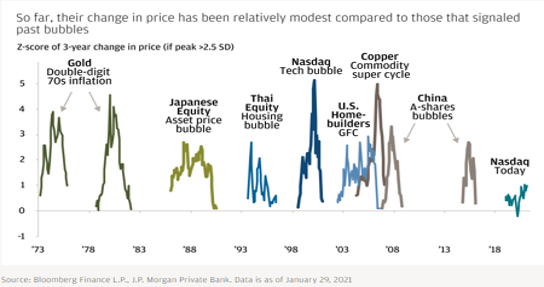

But I feel instead of looking to Icarus as a parable and warning, we should be reviewing the mythology of Nike the Goddess of Victory. According to Greek mythology, Nike held the role of Divine Charioteer and flew around battlefields rewarding victors with glory and fame. And, like Nike, we need to be looking for positives and areas of growth to reward and invest in rather than expecting doom and gloom. Bubbles tend to persist for longer than we think is possible. Yes, market valuations are high, inflation growing, tax code changes could drag on earnings, and fear is bubbling up. But there are many positives as well; improving economic conditions, pent up demand, stronger consumer balance sheets and lower personal debt levels all can help drive further returns. Different parts of the market will react differently over the coming months and years. Pick your battles and invest wisely. Akin to the tech bubble, not all parts of the market have sky high valuations or will react the same to rate hikes and inflation.

Irrational Exuberance was first mentioned by former Fed Chair Allen Greenspan on December 5th, 1996. It took 3+ years of markets continuing to climb until the March 2000 tech bubble burst along with the first tightening in interest rates. The first documented market bubble dates to the Dutch Tulip Mania, which crashed in February 1637 after prices peaking at a rate so high that a single tulip bulb sold for more than 10x the annual income of a skilled artisan. This event led to the publication of Extraordinary Popular Delusion and the Madness of Crowds, written by Scottish journalist Charles Mackay in 1841. Mackay beat Greenspan by 250+ years that people are impacted by crowd psychology and the desire to get rich quick and participate in the mania. Keep your wits about you- look for bargains not tulips!