January Market Brief

2022: The Year of The Mid-Term

“Once more unto the breach, dear friends, once more” –Shakespeare, William, Henry V, Act III Scene I

How to talk about politics, elections, and the market without talking about politics? Discussing anything political to a broad audience feels like preparing to cliff dive into a pool of porcupines. However, I still feel it’s important to put politics into perspective. 2022 is a big mid-term election year and the American public is about to be bombarded with “facts” about the current state of our nation. Campaign advertisements will most likely make our current economic situation sound dire (it’s not), the country close to ruin (again, it’s not), and a divided constituency that can only be united by voting for that particular candidate. Remember to take these financial talking points with a grain of salt, as economic cycles will influence market returns far more than elections ever will.

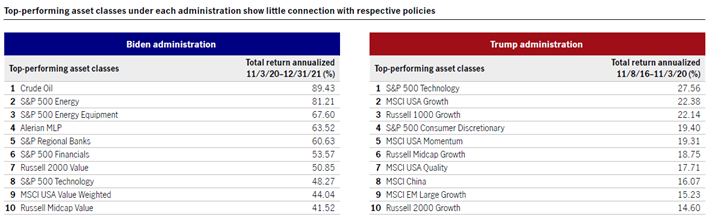

If I had told you that energy and financials were the top performing sectors over the last 12 months and then asked you if it was a Democratic or a Republican Administration, in general, the answer would be Republican. The chart below summarizes top performing asset classes during the most recent administrations. While the respective time periods are different, the fact that energy has thrived during an administration deemed hostile to the industry, and that tech was the best performing asset class under an administration that routinely disparaged the sector, is a great example of how little sway politics has over stock market performance.

During the last 75 years markets have been extremely resilient with the Dow Jones Industrial Average Index producing 8.3% on average per year and surviving 12 recessions, multiple wars, and countless bubbles & crises. The only political constant over that time was change, as the party in power will always be in flux. Markets actually perform best during periods of balanced power with one party in the White House and another in Congress. During these time periods of split power, per a CFRA study2, the political scenario with the highest historical return is a Democratic President and a Republican Congress under which the S&P 500 averaged 13%. Companies do not build new manufacturing facilities or plan expansion into new territories based on a short 2–4-year political cycle. Most companies plan 30+ years into the future and anticipate a fluctuating tax code, changing regulatory environments, and political power flip flops. So as political ads return to our TVs and social media feeds, keep in mind the market and the economic cycle most likely do not care.

1 John Hancock Q1 2022 Market Intelligence, 2022 Outlook, Pg.10

2 https://www.cnbc.com/2020/11/03/are-republicans-or-democrats-better-for-the-stock-market.html