April Market Brief

April Showers, May Questions

“Into each life some rain must fall/ Some days must be dark and dreary.” The Rainy Day, Henry Wadsworth Longfellow

Markets have enthusiastically reminded us about volatility and risk so far this year, but being an investor means occasionally taking your knocks when markets are down. There has been nowhere to hide in 2022, with stocks and bonds both taking a beating and minimal havens (gold, cash, energy) to provide support. Our recent bearish pivot was driven by concerns on inflation and labor costs dragging on profit margins. Additionally, we feel the world is shrinking with sanctions. It is yet to be known which side China, India and a few other quasi-allies-not-really-allies-but-we-need-them will end up on. A smaller world offers less opportunities for growth and sales and makes a more uncertain future. The ability to grow profits is what drives the markets up. While the US consumer is historically strong right now, we cannot pick up everyone’s share of growth.

Since the mid 1970’s the US has seen a period of strong economic growth powered in part by the globalization of trade. Globalized trade, however, seems to have peaked in 2007 when 61% of US GDP was created by the sum of all imports and exports. This last decade has been more about slowbalisation (as the Economist termed it), with rising tariffs and barriers beginning to reduce free trade. Outsourcing and global trade allowed the US economy to boom and shift towards a service and high-tech based economy vs. one that produces basic goods. This slowing global trend started over a decade ago but accelerating the last few years with Brexit and COVID putting pressure to reduce international entanglements. Historically, an insulated economy is difficult to grow and tends to cut off potentially profitable markets as well as reduce economies of scale and efficiencies. Isolationism as a policy has not proved to be successful, and generally comes at a high cost, both in dollar terms and lifestyle. Reduced imports typically lead to reduced export opportunities as well. Tit for Tat. We may import $2.24T in goods, but we also export $1.34T and benefit from tourism.

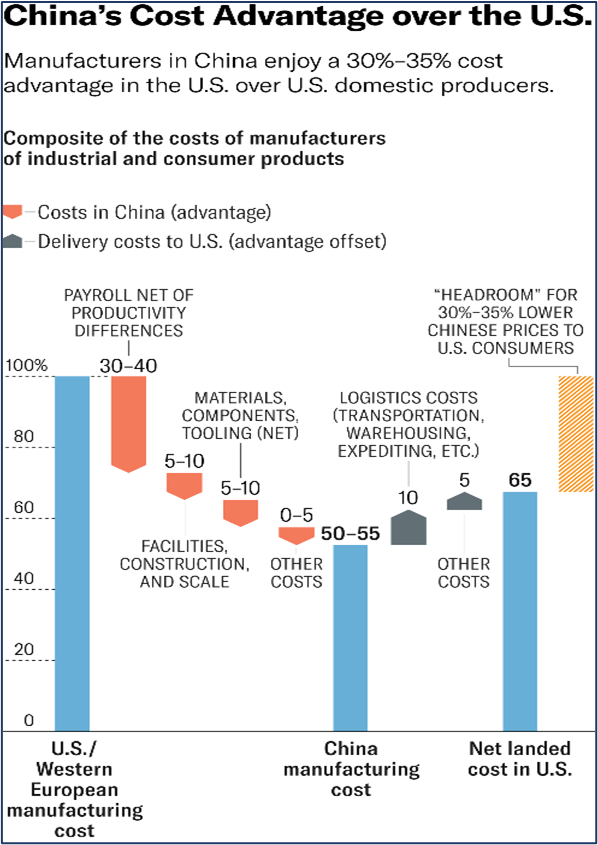

This graphic from the Harvard Business Review compares the cost of manufacturing in China vs. the USA in 2020. Efficiency tells us to use the lowest cost inputs to achieve the highest profit margins. Most publicly traded companies have the goal of profit maximization for their shareholders. However, as Europe is grappling with now, outsourcing critical components of your economy to an unfriendly-at-best neighbor can have dire consequences if those relationships sour. How do you rebalance trade without crushing your own economy? Who bears to costs of reducing counter party risk and on-shoring more production in the USA? The consumer can only bear so much. Russia attempted to build a “fortress economy” to insulate it from backlash for its terrible actions in Ukraine, but it has not worked according to plan, with cracks showing in banking, manufacturing and goods & services. Nevertheless, in 2022 with hard lines being drawn in the sand, can we afford the luxury of efficiency and low cost? Which countries are our fiends and who are our foes- explicit or implied- may determine the trajectory of the next decade. Just don’t take my guacamole and avocados!

Source: https://hbr.org/2021/12/a-new-approach-to-rebalancing-the-u-s-china-trade-deficit