July 2023 Market Brief

Whether Weather Withers Wealth?

“Rain makes corn. Corn makes whiskey.” – Rain is a Good Thing, Luke Bryan, Doing my Thing, 2010

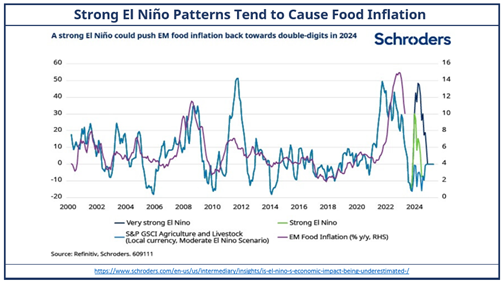

Recently, The National Weather Service and NOAA announced that there is a greater than 90% chance that El Niño will continue through the Northern Hemisphere winter. Weather patterns like El Niño and La Niña have historically affected commodities since they tend to bring more severe weather patterns. Per NOAA, ENSO (El Niño Southern Oscillation), refers to the large-scale ocean-atmosphere climate phenomenon linked to a periodic warming in sea-surface temperatures across the central and east-central equatorial Pacific. El Niño is the warm phase, La Niña is the periodic cooling phase. These temperature changes in the Pacific Ocean affect the patterns of rainfall which can cause flooding or drought depending on the location. They are a naturally occurring event, resulting from interactions between the ocean surface and the atmosphere over the tropical Pacific. With El Niño highly probable this winter, it could mean multiple direct and indirect effects on the Global Economy, and especially emerging economies.

Emerging economies tend to be more sensitive to commodity price fluctuations- especially agriculture. Agriculture is a major driver of growth in poor countries, and while it’s only 4% of overall Global GDP, for many emerging nations it can account to 25%+ of their GDP, especially countries in Africa, Southeast Asia, and Latin America. Think about where you get your cocoa, coffee, and sugar from, and who grows the rice and wheat to feed the almost 8 billion people on this planet. Food is also a larger proportion of spending in poorer countries with food being over 50% of India’s CPI weight vs. 15% for the USA. We are finally seeing inflation ease across multiple markets, and a severe weather pattern could cause agriculture prices to rise once again and put upward pressure on food costs. For example, with a drought now expected in the Midwest- US corn and other agriculture futures started rising in anticipation of lower harvests. Corn is considered most at risk since this heat and drought come during their pollination phase, which could significantly impact yields. El Niño comes and goes, but investors should be aware of the correlation and effects between severe weather patterns, agriculture, inflation, and economic growth. While we are cautiously bullish about emerging market investments right now, mostly due to the US Dollar weakness, commodity prices have an outsized effect on their performance. And a severe hurricane season could cause prolonged outages in coastal oil and gas drilling and refining, pushing fuel costs up once again. So, while El Niño should not be the only factor to be considered in your investment decisions in 2023, weather cycles should not be ignored.