October 2022 Market Brief

Election Blues

“We’re all bored. We’re all so tired of everything.” Taylor Swift, New Romantics, 1989.

Writing about politics in this era feels akin to walking into a lion’s den slathered in BBQ sauce. However dangerous it feels, as we head into a highly contentious November 8th its important you have some perspective about mid-term elections and the stock market. Mid-term elections historically see the incumbent party lose control and lose seats. On average since the 1960’s, the President’s party loses -23 House seats and -3 Senate seats. This is not always the case, but on average mid-terms tend to limit the party in control of the White House. Mid-terms are also one of the weakest seasonal years of the 4-year presidential cycles. According to Ned Davis Research, from 1900-2021 in Year-2 (the Mid-Term year) the Dow only averages 3.1%, vs. 12.7% Year 1, 14.8% Year 3 (the pre-election year), and 7.4% year 4 (the election year). This year is seasonally the weakest year of the 4-year presidential cycle.

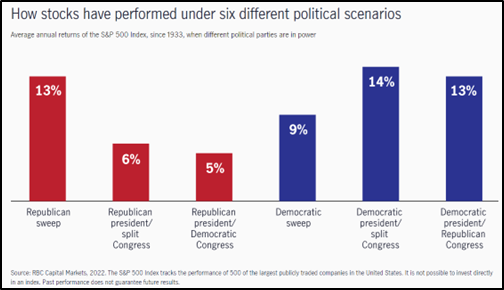

What, as an investor, would you want to see happen this November? A split government. The S&P 500 performs best with divided government (see chart below), as it provides stability in legislation with no major overhaul bills or massive regulatory changes anticipated. Gridlock is good. Big change tends to disrupt the markets, and companies don’t think in terms of 2 years or 5 years, most think in terms of decades if they are investing in new expansions or large capital projects. Favorable political regimes will come and go, and unfavorable policies will also ebb and flow over 30+ years.

The only constant in politics is change, which is why the markets care less about individual elections than you, the average US Citizen does. Make sure you vote!

Source:

1https://www.jhinvestments.com/The-2022-midterm-election-and-the-markets#market-reaction