“Summertime, and the livin’ is easy.” –Ella Fitzgerald.

“Summertime.” –Porgy & Bess, 1957.

It’s impossible to check the news and not see mention of the Delta variant clawing its way back into our lives. Has this recovery been a false start? Are the announced mask mandates in Los Angeles a harbinger of more to come? The world and the markets feel, once again, on edge. We caution against letting fear dictate your portfolio allocations and direction. There will always be something scary in the world; today it’s COVID, tomorrow, who knows- war with Cuba? Fear is an uncomfortable feeling that we need to be comfortable with to invest long term. Markets go up and they go down; the ebbs and flows are ever changing.

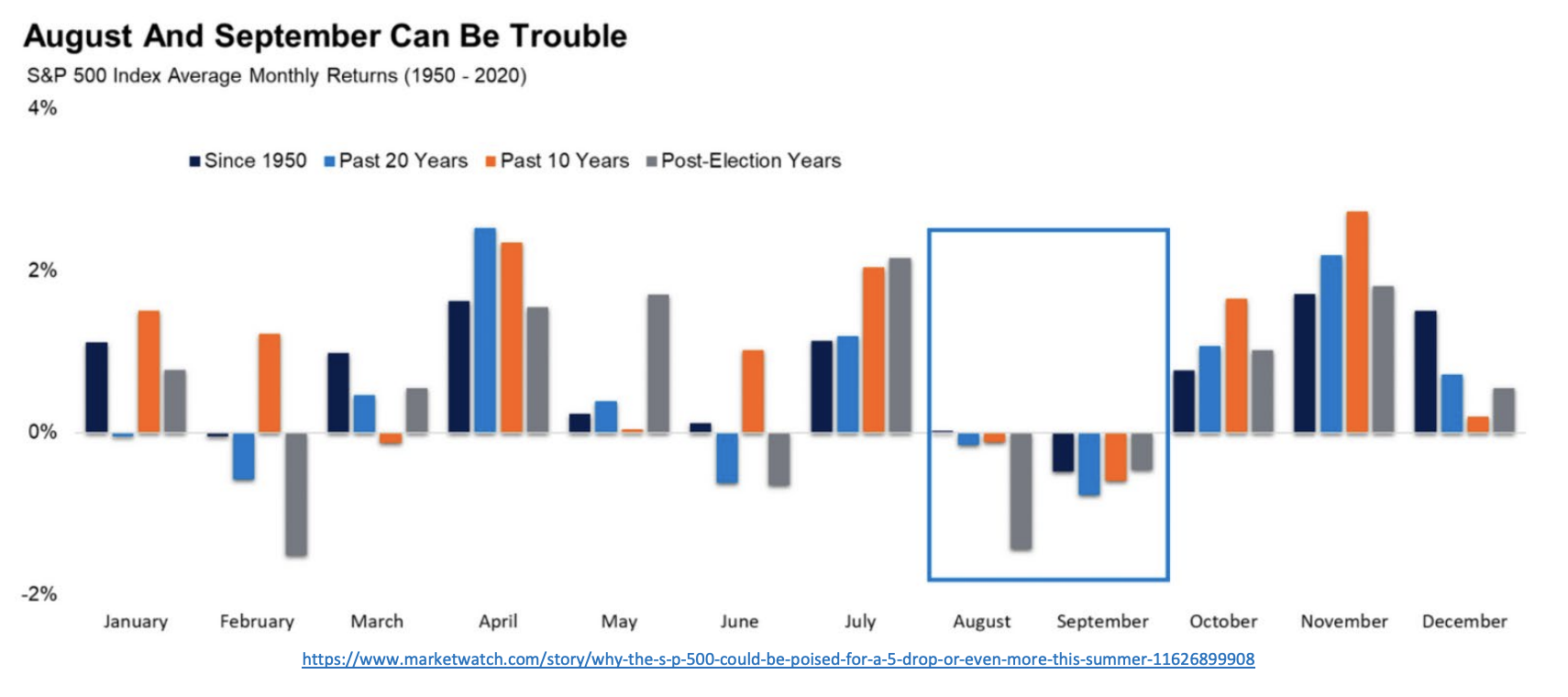

I am often reminded by my clients to Sell in May and Go Away. Analyzing the data proves this adage flawed at best; it gives May, June and July a bad rap! Going back 25 years, May, June, and July on the S&P 500 average positive returns of 0.37%, 0.16% and 0.84% respectively. However, August averages -0.64% and September -0.27% which are historically the weakest months of the year (along with February -0.34%, but February is just a miserable month in general, so everyone expects it to be terrible). The “Summer” period (May 1st -Oct 31st) is traditionally weaker on average than the “Winter” period of Nov 1st- April 30st. If you go back further through 1926, the only month that averages a negative return is September. Below is a good chart summarizing Monthly Returns on the S&P 500 over different time periods.

We are wary of, and ready for, more volatility and pullbacks as we head into August and September. The markets have been extremely calm so far in 2021, but it’s expected we experience pullbacks over the summer lulls. It’s never a linear recovery. We expect as the Delta variant comes roaring back reminding us of the ongoing Pandemic that we will see more drawdowns. We remain buyers of dips and not sellers of rallies. It’s always difficult to time a market, and while the wall of worry seems high, we feel that staying invested is the best course for investors to generate consistent returns and protect the real value of their assets against inflation.